Political Update – January 2021

It is near official. On Tuesday, the Georgia run-off elections flipped the Senate to equal 50-50 party control, giving the Democratic party unified government (the Vice President is the tiebreaker). It was a subtle change in the outcome when compared to the days following the general election. On Wednesday, a group of protestors stormed the US Capitol building and disrupted the Electoral vote count. Late into the night, Biden’s election was officially certified by Congress.

A lot has happened in the markets and news since the first few days of the year. In light of these events, we’ve identified some common client questions we have been receiving, and you may be asking too, and provided some insight for your references:

Should we be concerned that the events at the Capitol on January 6, 2021, or any further disruptions will shock the markets?

- The markets largely shrugged off Wednesday’s events at the Capitol building, as Congress reconvened and tabulated the Electoral votes. Shockingly, even as the events unfolded, the stock market held up its strong gains on the day. The markets have grown numb to political events, unlike any other time in recent memory. We expect additional unforeseen political turbulence over the next two weeks, but evidenced by recent days, markets appear more drawn to the long-term prospects of stimulus, growth, and stability.

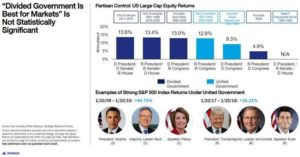

How has market performance been during periods where one party controls the Presidency and Congress?

- In short, there is no statistical evidence to prefer either a united or divided government, the sample sizes are far too small, and other influences are too large to make that claim. Therefore, allocation decisions should not solely be guided by the current democratic configuration.

- Per our friends as Invesco, the graphic below describes it well. The pricing of securities is a function of inputs far deeper than which political party is in control. Policy does matter but is offset by larger-scale factors such as innovation, growth, and fundamentals. The Invesco analysis suggests this to be largely accurate.

Should we be concerned in the near-term about Biden’s policy changes?

- Biden’s policy motives can be simplified into growth objectives and increased revenue goals.

- We expect little resistance to additional government spending under a democratic-controlled Congress. Assistance through government programs to low-income earners, incentives for renewable energy creation, and further government support in healthcare are all on the table. In isolation, these can be viewed as bullish for the stock market.

- We expect taxes to increase, but the timing and the extent are questionable. Slight increases in tax rates on high-income earners and capital gains should be expected. Large increases and significant taxes levied on corporations could prove to be politically difficult. With how tight the Senate remains, passing a large-scale corporate tax increase only needs minimal resistance from any dissenting Democratic senator. Over the short-term, the political will to increase taxes during the pandemic is likely low.

- Regarding growth as a result of policy, taxation policies will likely conflict with overall economic growth, while other spending policies may stimulate it. When it comes to measuring the net impact between the two forces in play, the devil will be in the details. As mentioned above, bigger influences around innovation, demand, and fundamentals are likely a much bigger driver than any policy impact.

If you have any additional questions or concerns, please reach out to your advisor. We’re always here to help.